Our Operations

Click on a section of the map for more information

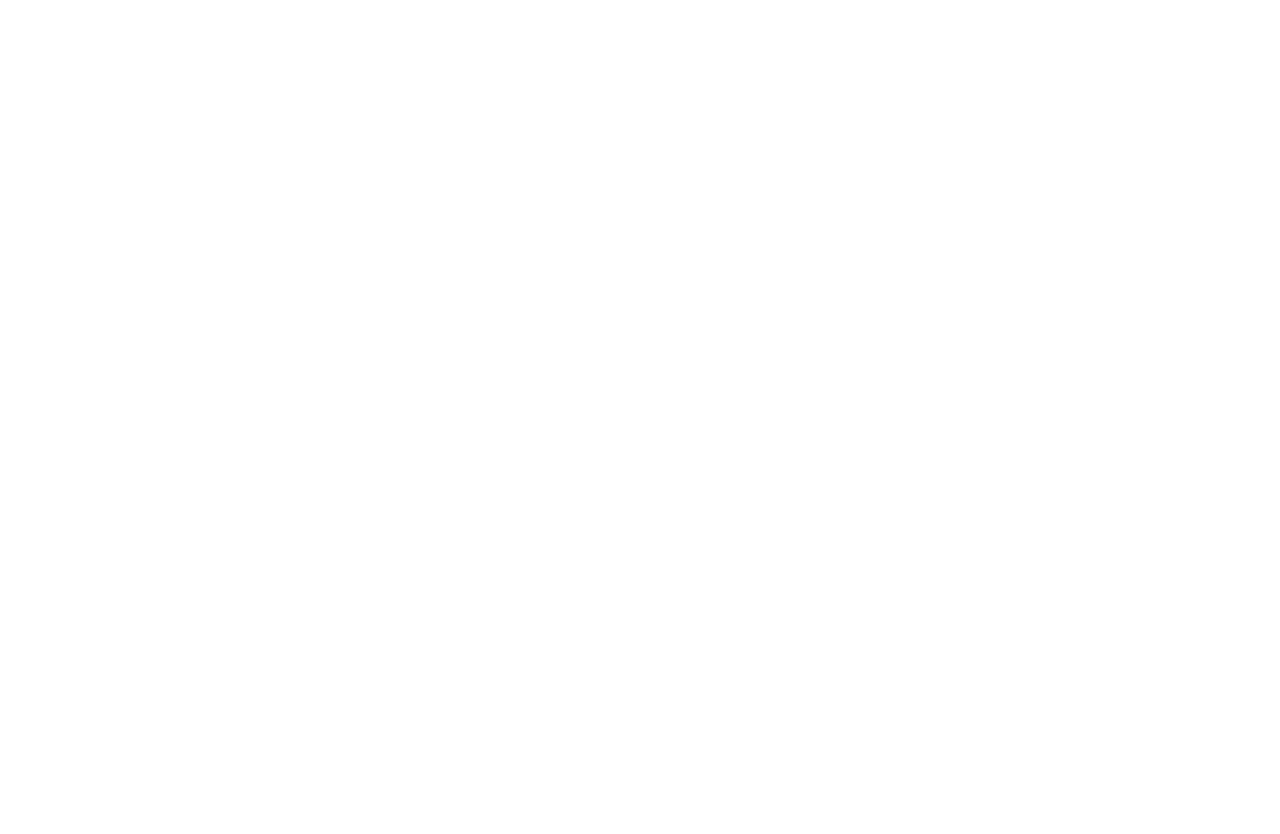

Crude Oil Developed Acreage

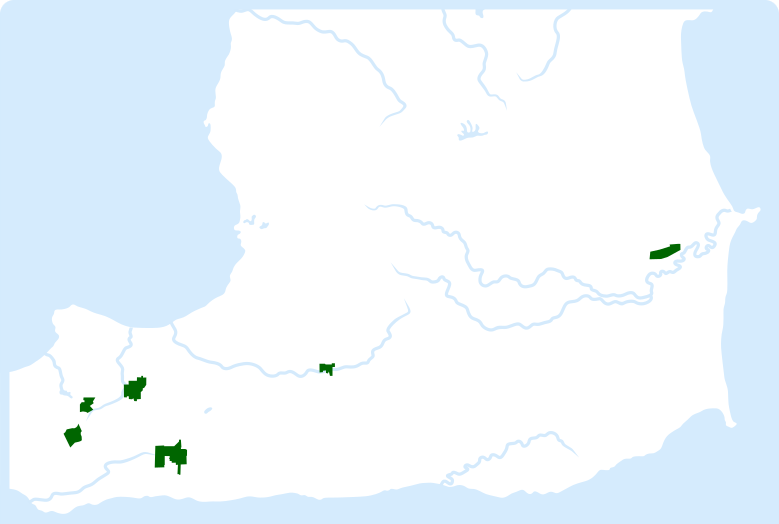

Natural Gas Developed Acreage

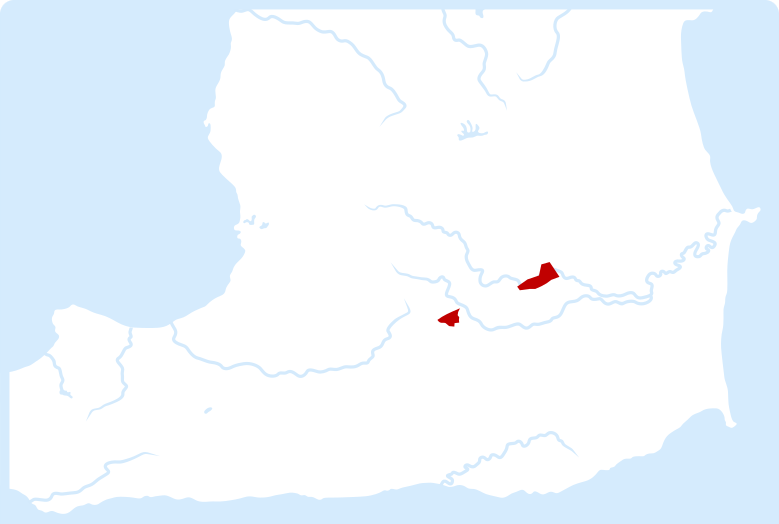

Exploration Acreage

Crude Oil Developed Acreage

Touchstone possesses a portfolio of longstanding oil assets located onshore Trinidad. These assets have played a pivotal role in the Company’s expansion and achievements by ensuring consistent production volumes.

KEY INFORMATION

| Year-to-date June 30, 2024 average daily production (net) | 1,162 bbls/d |

| 2023 2P reserves (gross) | 14,349 Mboe |

| Net acres | 4,625 |

Exploration Acreage

Touchstone’s land position in Trinidad encompasses several exploration blocks, including Ortoire, Cipero, Charuma, and Rio Claro.

KEY INFORMATION

| Net acres | 137,312 |

| Formation structures | Herrera, Cretaceous, Nariva |

Natural Gas Developed Acreage

In 2019, Touchstone initiated the first phase of it exploration program, resulting in five successful exploration and appraisal wells at Coho and Cascadura. These discoveries demonstrate the potential of the company’s prospective acreage position within the Herrera formation.

KEY INFORMATION

| Year-to-date June 30, 2024 average daily production (net) | 5,061 boe/d |

| 2023 2P reserves (gross) | 53,030 Mboe |

| Net acres | 2,956 |

Natural Gas Developed Acreage

In 2019, Touchstone initiated the first phase of it exploration program, resulting in five successful exploration and appraisal wells at Coho and Cascadura. These discoveries demonstrate the potential of the company’s prospective acreage position within the Herrera formation.

Crude Oil Developed Acreage

Strategically located within the prolific Southern Basin of Trinidad, our legacy oil assets provide reliable production volumes and have been instrumental to our historical growth and success over the years.

Exploration Acreage

In recent years, we have expanded our land holdings in Trinidad, obtaining the Ortoire, Cipero, Charuma, and Rio Claro blocks.

Touchstone possesses a portfolio of longstanding oil assets located onshore Trinidad. These assets have played a pivotal role in the Company’s expansion and achievements by ensuring consistent production volumes.

KEY INFORMATION

Year-to-date June 30, 2024 average daily production (net)

1,162 bbls/d

2023 2P reserves (gross)

14,349 Mboe

Net acres

4,625

In 2019, Touchstone initiated the first phase of it exploration program, resulting in five highly successful exploration and appraisal wells at Coho and Cascadura. These discoveries demonstrate the potential of the company’s prospective acreage position within the Herrera formation.

KEY INFORMATION

Year-to-date June 30, 2024 average daily production (net)

5,061 boe/d

2023 2P reserves (gross)

53,030 Mboe

Net acres

2,956

Touchstone’s land position in Trinidad encompasses several exploration blocks, including Ortoire, Cipero, Charuma, and Rio Claro.

KEY INFORMATION

Net acres

137,312

Formation structures

Herrera, Cretaceous, Nariva